When Aqua Comms CEO Nigel Bayliff sat down with InterGlobix Magazine’s Editor-in-Chief Jasmine Bedi, a wide range of subjects were discussed. Among these were the subsea operator’s very recent acquisition by Digital 9 Infrastructure (a publicly traded fund), their unique North Atlantic Loop and the latest innovations in the subsea industry. Referencing themselves as “a carrier of carriers,” Aqua Comms was founded in 2014. In just seven years the company built a strong reputation as the owner and operator of 14,300 km of the most reliable and resilient trans-Atlantic subsea fiber systems that form the backbone to the Internet.

Aqua Comms’ Bayliff is a 30-year veteran in the global telecommunications industry. He has been an advisor and consultant to clients in cable development, private equity and the government. In 2012 Bayliff was named Vice-Chairman to the United Nations Joint Task Force that analyzes the data gathered on disaster mitigation and the climate from undersea cable systems worldwide. He also has held executive leadership positions at Global Marine Networks and FLAG Telecom, in addition to having been elected a Fellow of the UK Institute of Engineering Technology.

Aqua Comms was recently acquired by the digital investment trust Digital 9 Infrastructure PLC (AKA D9). How important was this and what does it mean for the company?

Let me start by sharing more about D9. The 9 in Digital 9 represents the UN’s Sustainability Goal No. 9 in the UN Charter, focusing on providing reasonably priced infrastructure throughout the world. Digital 9 Infrastructure PLC (D9), is an LSE listed investment trust supported by investment manager Triple Point Investment Management LLP and the fund’s work explores a variety of infrastructure assets associated with the Internet’s foundation layer.

Primarily, these assets include: submarine cable, renewable-energy powered data centers, terrestrial fiber networks and radio distribution technologies, the last includes the 5G rollout of distributed antenna systems–the new era of towers. D9 launched on the London Stock Exchange in March 2021, with an IPO of £300 million. Following the IPO, and only one day after launching, D9 used £160 million / $215 million to acquire Aqua Comms. I consider this a solid vote for our work and what we’ve accomplished. Aqua Comms acquired its first subsea cable, Celtic Connect, in 2015. Since then, we have built an organization that owns and operates a current network of five subsea cables. From Ireland, traversing across the Atlantic with European connectivity, we’ve grown our customer base and partnerships throughout our subsea systems into major European hubs.

As the market moves toward infrastructure as a service, Aqua Comms continues as the dependable carrier-neutral party delivering capacity efficiently across the Atlantic on a range of cables. That was a major attraction for D9 to make this investment and bring us into their fund, to pass that benefit on to the fund’s investors and owners.

At Aqua Comms, we don’t purely have the advantage of new-era cables that are much denser than older cables, and result in lower operating costs and much higher capacities. Lending an advantage is our innovative management model that we’ve implemented efficiently to have senior management directing the work of well-recruited outsource agencies handling the work on both sides of the Atlantic.

Our infrastructure operations ethos is best explained in terms of trains. We solely operate the train tracks. We don’t conduct trains. We don’t collect ticket money. We don’t maintain train stations. We just run the train tracks as efficiently as possible and to give the widest array of people access to them. There’s no layer where we’re clashing with our customers. As an example, we don’t sell to enterprise customers. We strive to truly be what we say we are: a carrier of carriers.

Although very successful, our model has proved to be the most challenging in The Atlantic market, which is very high volume and low margin. Being able to make it work there shows that this model will potentially operate more efficiently and create a larger margin as we move into the Mediterranean and Middle East, towards India and across the Pacific.

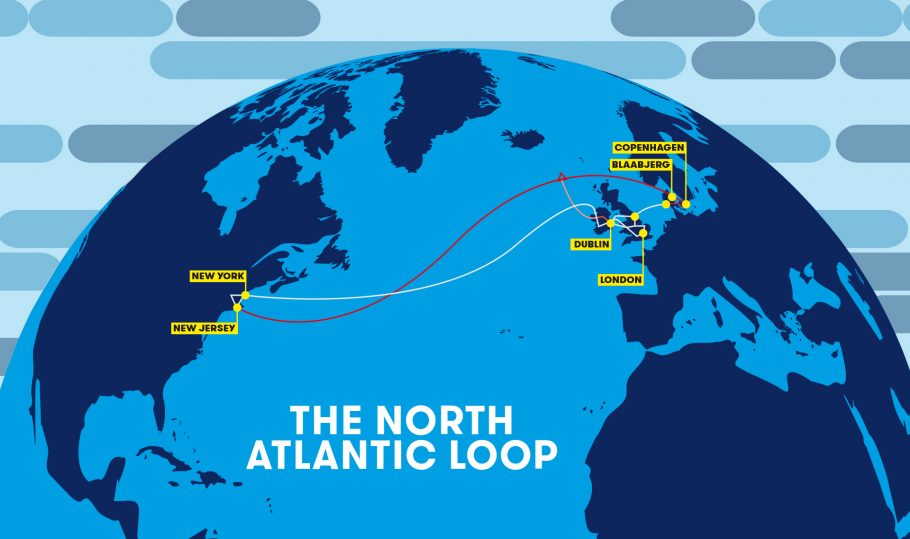

What is the importance of Aqua Comms owning and operating The North Atlantic Loop that crosses the Atlantic?

When I was building the last generation of cables across the Atlantic, many were loop cables. These were constructed in a ring-based infrastructure, with SDH SONET technology to provide switching between the different paths at a rate of 50 milliseconds, so service maintains even if a cable breaks.

These days, when we need the capacity of Gigabit Ethernet and beyond across an ocean, then switching technologies in the optical domain doesn’t quite work the same. People are often looking for, multiple paths that have no common failure points. Our solution was to construct The North Atlantic Loop out of our five principal cables–AEC-1 into Ireland,

AEC-2 into Denmark and regional cables interlinking everything. By connecting them, it’s easier for someone along any point on our network to reach two completely different paths. This then enables complete diversity across a multitude of routes, including the backhaul of a landing station, short regional cable connections and trans-Atlantic connections.

Currently, in the US we have the capacity to deliver in New Jersey and New York. Our plan is to add a third cable, AEC-3, in mid-2022. This subsea system will run from north of New York into the UK, providing a diverse connectivity route. Making it possible, as one example, from London to access major North American data centers via three separate paths across the Atlantic. After AEC-3, we have plans for AEC-4 and AEC-5, which will continue the execution of our strategy to expand our asset class across the Atlantic.

As AI has begun to play an important role in the Internet infrastructure sector, how does Aqua Comms plan on deploying it network-wide, specifically via the Ciena partnership?

Firstly, our quality and consistency in the underlying asset layer grew even better in our newer cables. Now, as we’re selecting equipment, we’re looking for what maximises the most out of the cables around flexibility and for obtaining the maximum capital efficiency.

Networking equipment manufacturer, Ciena comes in as our partner to offer key AI components that get us to that max efficiency. Because, by understanding the predictive forecasting capacity along different parts of the spectrum on separate networks, our team can operate effectively. Ciena’s AI tools have shown us: 1) how that optical layer works, 2) how to load extra amounts of capacity onto certain parts of the spectrum and 3) how the spectrum can be managed across the whole spectral width of the cable. When we combine our skill and knowledge of operating infrastructure with the toolset and data driven from Ciena’s equipment, then we’re empowered to get the best results.

By partnering with Ciena, we were able to bring 400 Gbps service to market. Ciena’s AI tools were utilized to find the precise time to deploy such technology into our network as by deploying too soon, you’re not capital efficient; however, if deploying too late, you potentially miss first-mover advantage. AI gave us a better understanding of our assets and, specifically, how to tune them to best benefit our customers and shareholders.